The True Cost of Waiting: A Guide for Columbia, SC Homeowners

- Paul Fisher

- Oct 14, 2025

- 7 min read

Updated: Nov 2, 2025

Introduction: The Invisible Clock Ticking on Your Property ⏳

For many Columbia, SC homeowners, the decision to sell a property is often weighed down by a simple yet powerful consideration: time. It’s easy to look at a property that needs work—a leaky roof, peeling paint, or a garden that’s gone rogue—and think, "I'll get to that later," or "I'll just wait for the market to improve."

This line of thinking, while understandable, often masks a costly reality. In the world of real estate, procrastination has a high price tag. We’re not talking about missing out on a few extra dollars; we're talking about the significant, compounding decline in value caused by deferred maintenance and the simple passage of time.

At Fish Pond Property, we often meet homeowners who have been struggling with a difficult or unwanted property for years. Their situations are diverse—from managing a tough inheritance to dealing with foreclosure, or simply trying to offload a burdensome rental—but a common thread is the financial and emotional toll exacted by delay.

This article is designed to be an informative guide, offering valuable knowledge about the hidden and visible costs of putting off necessary repairs and delaying the decision to sell a distressed property. Our goal is to empower you with the facts so you can make the best, most timely decision for your unique situation.

Defining the Vicious Cycle of Deferred Maintenance: The Cost of Waiting

The term "deferred maintenance" sounds technical, but it’s straightforward: it’s the practice of postponing necessary repairs, upkeep, and preventative measures on a property. This is often done due to immediate cost concerns, lack of time, or the sheer emotional strain of managing a difficult property.

The core issue with this practice is that minor problems don’t stay minor. They are almost always interconnected and worsen exponentially over time. This creates a vicious cycle of deterioration that rapidly eats away at your home’s market appeal and structural integrity.

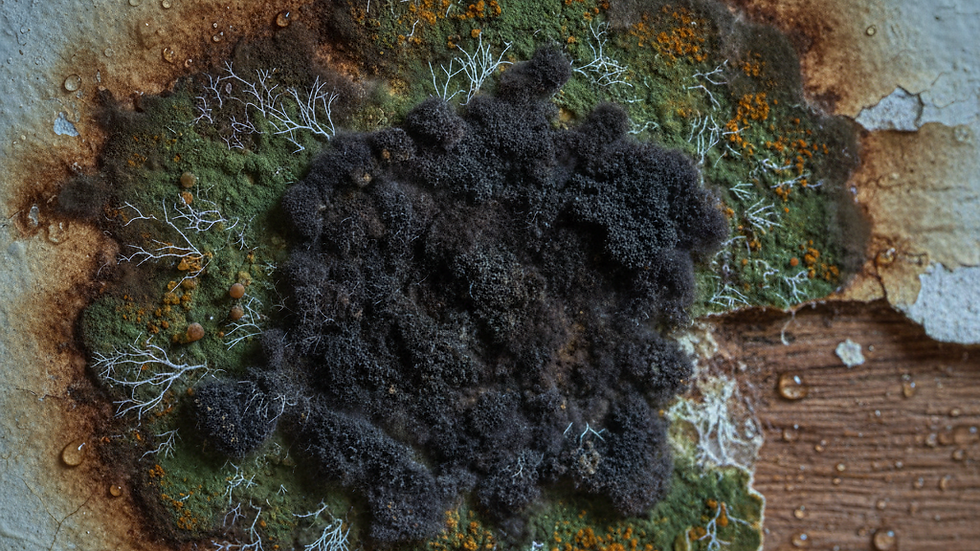

Consider how something as simple as a small, slow plumbing leak or a missing shingle on the roof can spiral out of control. When ignored, water is inevitably introduced where it doesn't belong. This water saturates the subfloor and drywall, creating an ideal environment for mold and mildew to grow, or it can damage insulation and ceiling sheetrock after entering the attic.

At this point, fixing the initial problem—the small pipe or the shingle—is a tiny fraction of the total repair. The homeowner is now faced with costly remediation for mold, replacement of compromised subflooring and drywall, and potentially structural repairs. In many cases, what began as a $100 fix rapidly morphs into a $10,000 problem.

Furthermore, neglect of essential maintenance makes the property vulnerable to more significant, insidious damage. Pests, such as termites and carpenter ants, are naturally attracted to properties with wood-to-ground contact, excessive moisture, or decaying materials—all common symptoms of deferred maintenance. An untreated pest problem can quickly compromise the structural integrity of the home.

Likewise, the continued neglect of annual HVAC servicing or ignoring a sputtering water heater inevitably leads to complete mechanical failure. These are major systems that buyers expect to be functional. Replacing a central HVAC unit in Columbia, SC, is a large, non-negotiable expense that a typical buyer will demand be addressed. If not, they will dramatically reduce their offer. This multiplication of repair expenses and the subsequent reduction in the property's potential sale price is the true cost of waiting.

The Time Tax – How Waiting Affects Your Bottom Line

Beyond the physical deterioration of the property, the simple act of delaying a sale imposes several unavoidable financial burdens, often referred to as the "Time Tax." The most immediate burden is the collection of carrying costs that drain your finances every single month you own a property.

If you are struggling with a difficult property, this is an expense you are carrying while the home's value is simultaneously declining due to maintenance issues. These expenses include continuous mortgage payments (in situations of overwhelming debt or an underwater mortgage), mandatory property taxes owed to Richland County, and increasingly expensive insurance premiums. Insurance for a vacant or abandoned property is often significantly higher due to the elevated risk of vandalism, theft, or undetected damage.

By waiting a year to sell, these cumulative expenses can easily total over $18,000 annually. This money is spent just to hold onto the problem, before any needed repairs are even considered.

Furthermore, by waiting, the seller is subjecting their finances to market risk—a gamble on future economic conditions. While the Columbia real estate market has generally been robust, markets are not static. Economic shifts, rising interest rates, and local employment changes can quickly cool buyer demand.

By delaying, you risk a scenario where interest rates rise, which reduces a buyer's purchasing power and forces them to offer less for the same house. You also risk increased inventory, where your distressed property must compete with many move-in-ready alternatives, or a simple drop in demand, leading to fewer offers and less competition. Waiting removes the power of quick, decisive action and subjects your finances to unpredictable economic forces.

For those facing extreme financial distress, the Time Tax is the most punishing. Delaying action when facing foreclosure means accumulating more late fees, legal costs, and attorney's fees charged by the lender. These costs are added to the total amount owed, making it even harder to pay off the debt.

Similarly, unpaid property taxes result in tax liens, which accrue interest and severe penalties. The longer you wait, the greater the penalty, sometimes leading to a tax sale where the owner loses the property and any remaining equity.

The Traditional Sale Barrier and the Deal-Breaker

A home with significant deferred maintenance or damage simply does not fit into the traditional real estate model. Sellers must understand why this method will often fail for a distressed property.

The main obstacle is the lender requirements and appraisals. The vast majority of traditional buyers rely on a mortgage to purchase a home, and lenders have strict requirements because the home serves as collateral. If a property has major structural damage, a non-functional HVAC system, a severely leaky roof, or active mold, it will often fail to meet the minimum property standards set by the Federal Housing Administration (FHA) and conventional lenders.

If the house fails to qualify for standard financing, the buyer cannot get a loan, the deal collapses, and the seller is back to square one. This process is not only frustrating, but the property then becomes "stale" on the market, deterring future conventional buyers.

Even if the property makes it through the initial appraisal, it will face the inspection negotiation nightmare. A traditional buyer will always order a detailed home inspection. When the report returns with pages of required repairs, the negotiation shifts entirely in the buyer’s favor.

Buyers don't just ask for the cost of the repair; they demand a significant discount, often 1.5 to 2 times the repair cost, to cover their hassle, risk, and inconvenience. This is often referred to as the "double discount."

Furthermore, the buyer may require the seller to fix the issues before closing. This forces the seller to front the cash, manage contractors, and endure lengthy delays—the very complications they were hoping to avoid. Trying to sell a distressed property the traditional way results in long listing periods, failed contracts, stressful negotiations, and ultimately, a lower net profit than a direct sale.

The Unique Burden of Situational Properties

The costs of waiting are compounded when the property is tied to a difficult life event or unique circumstance. This adds an emotional and administrative cost to the financial one.

When a home is inherited, it often comes with a host of administrative headaches, particularly if it enters the probate process. If multiple siblings own the property, waiting can lead to protracted disputes and costly legal mediation over who manages or pays for repairs. This creates significant strain on family relationships. Moreover, the person named as the executor is personally responsible for the property's upkeep, paying taxes, and maintaining insurance during the probate period. This is an enormous, unpaid burden that is only lifted once the property is sold.

Similarly, in a divorce, the marital home is the largest asset that must be divided. Until the house is sold, both parties are typically tied to the mortgage. This prevents either from obtaining new financing for a separate residence. Delaying the sale forces ongoing, conflict-ridden negotiations over who pays for repairs and taxes. This drags out the financial separation and emotional healing. A quick, decisive sale provides the clean financial break both parties desperately need.

Finally, an unoccupied property in Columbia, SC, is a constant liability. The risk increases exponentially the longer it remains vacant. It becomes a magnet for vandalism, theft of appliances and copper piping, and illegal occupation by squatters. This can require costly and lengthy legal eviction processes. Additionally, city authorities often fine owners of abandoned properties for overgrown yards, uncollected trash, or structural hazards. This adds layers of fines and legal costs. The "Cost of Waiting" in these situations is not just financial; it’s a massive toll on peace of mind and personal bandwidth.

The Importance of Taking Action

Understanding the costs associated with waiting to sell your property is crucial. The longer you delay, the more complicated and costly the situation can become. Taking action sooner rather than later can help mitigate these issues and provide a clearer path forward.

If you find yourself in a difficult situation, remember that you have options. You can choose to sell your property quickly and without hassle. This allows you to regain control over your financial situation and move forward with your life.

Conclusion: Making an Informed, Timely Choice for Your Future

The decision to sell a property that is distressed, unwanted, or tied up in a difficult life situation is never easy. However, understanding The True Cost of Waiting—the compounding repair expenses, the monthly carrying costs, the market risk, and the immense emotional and administrative toll—is the first step toward reclaiming your financial and personal freedom.

When a property is defined by deferred maintenance, major damage, overwhelming debt, or a legal situation, the traditional route is often the most expensive and time-consuming path to a dead end. In these cases, the value of speed, simplicity, and certainty far outweighs the potential (and often illusory) promise of a higher price on the open market.

It’s about more than just selling a house; it’s about resolving a problem and removing a burden. Making a timely, informed decision allows you to stop the invisible clock, end the accumulation of costs, and move forward with your life.

At Fish Pond Property, we are dedicated to providing fair, transparent, and quick solutions for homeowners in the Columbia, SC area facing these exact challenges. We specialize in buying properties As-Is—meaning you don't have to spend a single dollar or minute on cleaning, repairs, or contractor management. We handle all situations: abandoned, vacant, foreclosure, probate, divorce, and major damage. If you’re ready to understand the cash offer option for your specific property, we are here to provide a confidential, no-obligation consultation.

Comments